Proposed plans to get rid of rules designed to protect largely low-income consumers from abusive high-interest loans risk the well-being of some of America’s most vulnerable households.

The United States Consumer Financial Protection Bureau recently announced the proposal to rescind rules that would have meant payday and auto-title lenders had to make sure that customers could repay loans under the terms of the contract. Loans not meeting this requirement would be considered unfair and abusive.

When people get trapped in predatory loan agreements, they can end up sacrificing their own and their families’ welfare in order to make the repayments. This rule would have helped prevent people from becoming trapped by these types of predatory payday and auto-title loans.

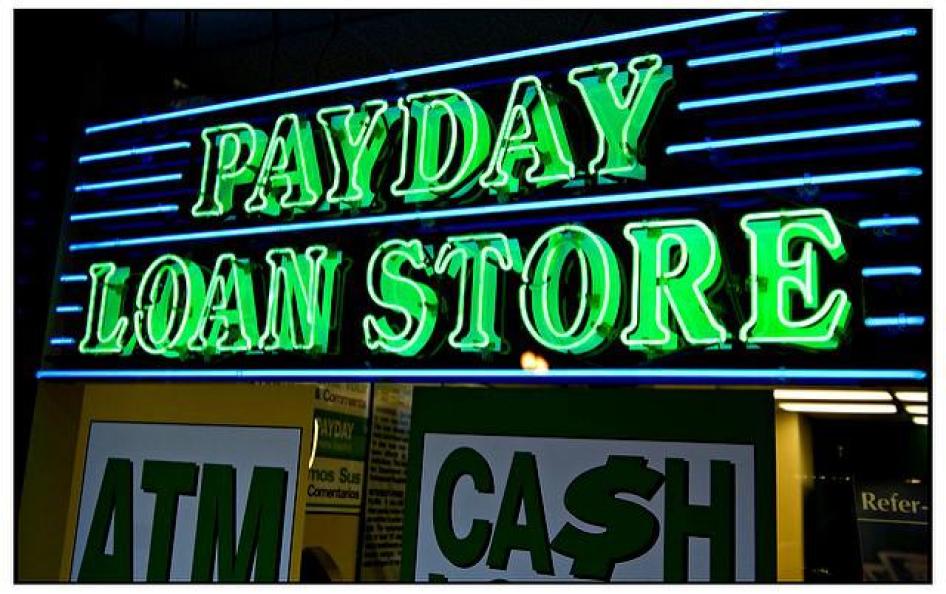

Many payday lenders exploit cash-strapped people, often with limited access to other forms of credit, by offering them small, short-term and high-interest loans. Some borrowers have reported paying triple-digit interest rates, in some states over 600 percent, on their payday loans.

Payments then balloon in size and people have difficulty keeping up, forcing some to choose between their loans and basic needs. Research has shown that payday lending disproportionately affects African American, Latino, and poor communities.

The Consumer Financial Protection Bureau’s rules on payday lenders, finalized in 2017, created a national standard and safety measures to prevent this trap of predatory interest rates for payday and auto-title loans, while still giving access to small dollar loans. The rule was created after an extensive public comment period, with the participation of both payday lenders and the public.

Since the final rule was announced, industry lobbies have pushed for a rollback, saying that the rules would limit the access of low-income communities to much needed credit. The answer to limited credit access is not to allow more loans offering extortionate interest rates and unrealistic conditions that ultimately leave borrowers worse off. The Consumer Finance Protection Bureau should instead be focusing its efforts on preventing abuse and empowering low-income communities to access fair credit with reasonable interest rates.

Stripping the very rules that protect the vulnerable does nothing to serve communities in need or advance consumer protections.